Introduction

In today’s fast-paced world, faster loan and credit card approval can make a huge difference when you need financial support. Whether you’re applying for emergency funds, building credit, or seeking convenience, speed is crucial. This guide will show you how to speed up the approval process and boost your chances of success.

Why Faster Loan and Credit Card Approval Matters

Waiting days—or even weeks—for a loan or credit card decision can be frustrating. Quick approval allows you to manage expenses, seize financial opportunities, or handle emergencies without stress. It also helps improve financial stability and supports better budgeting.

Tips to Achieve Faster Approval

Here’s how you can secure faster approval:

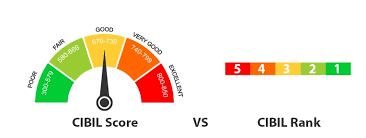

- Maintain a good credit score – Lenders favor borrowers with solid credit histories.

- Use prequalification tools – Many financial institutions offer online tools to check if you’re likely to be approved.

- Provide accurate documentation – Upload clear, up-to-date income and ID documents.

- Choose the right lender – Some lenders are known for faster loan and credit card approval processes.

Banks and Apps That Offer Instant Approval

Some digital banks and fintech apps specialize in lightning-fast decisions

What to Avoid During the Process

Don’t apply to too many lenders at once

Avoid incorrect or incomplete applications

Don’t ignore follow-up requests